What Areas Are Hot For Producer Recruitment

- November 10, 2023

- 3 min read

- Recruitment, Uncategorized

As we emerge from that “shake-up” that was COVID-19 and the shockwaves it propagated over the past four years, the insurance industry still continues to experience positive growth.

But not every segment is seeing the same rates of change and not every geographical area presents the same outlook.

So, how does that affect your agent recruitment? And what opportunities are there for your group if you’re looking at expanding your agent field and independent distribution numbers?

Let us dive into a few industry segments.

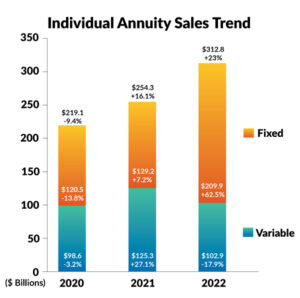

Record Annuity Sales Last Year

According to the Life Insurance Marketing and Research Association, the total annuity sales in the last complete year cycle increased over 20% from the year prior. FIA sales in particular experienced a 25% increase just as traditional variable annuity sales decreased.*

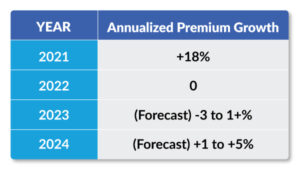

Life Insurance Sales

According to LIMRA, the total U.S. life insurance new annual premium was up only 2% by the second quarter of 2023. This confirms prior projections that the life insurance sector would look somewhat flat, especially compared to an explosive year in 2021. But not every sector did the same.

The Final Expense sector had a 5% decline in 2022 compared to the previous year. Verified Market Research still projects strong growth in the following years.

Specialty life-insurance segments such as the Hybrid Long Term Care market on the other hand aren’t just growing but also outpacing other segments.

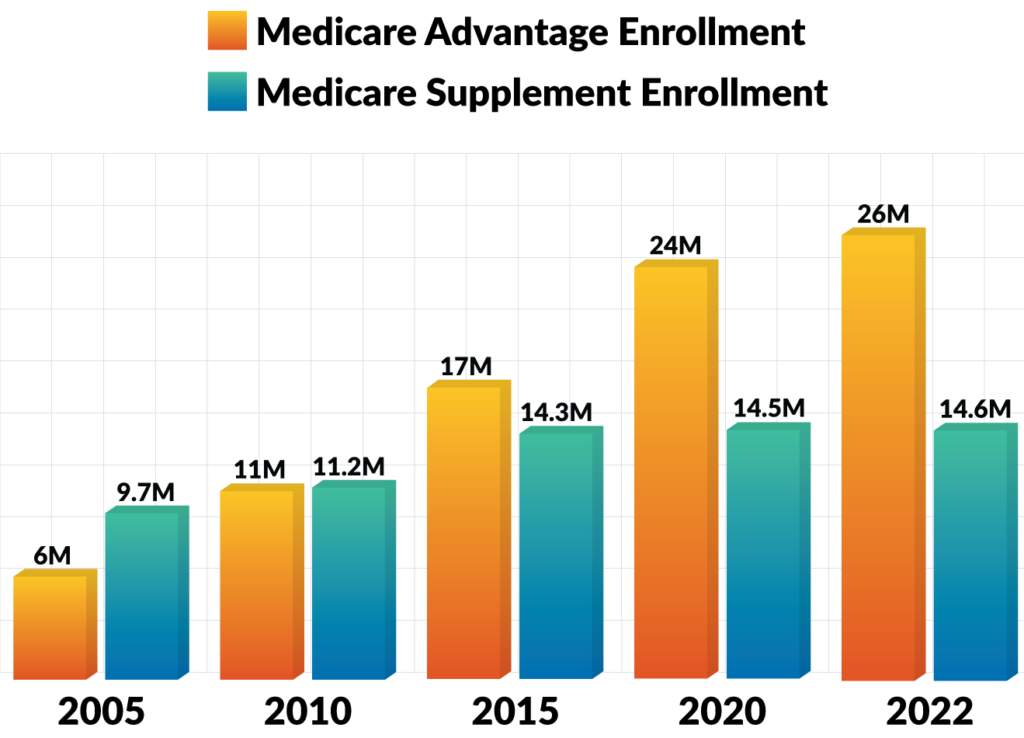

Medicare Enrollment on the Rise

According to the American Association for Medicare Supplement Insurance, Medigap sales in the last year increased compared to the last two years, and the increase in enrollment in Medicare Advantage in the same time period increased from 24 million to 26 million people enrolled. Not surprisingly, due to the size of their populations but also their aging populations the states of California, Florida, Texas, New York, Pennsylvania, and Ohio, in that exact order, lead in the number of beneficiaries. This begs the question: Is the number of agents increasing at the same rate in those states?

Not surprisingly, due to the size of their populations but also their aging populations the states of California, Florida, Texas, New York, Pennsylvania, and Ohio, in that exact order, lead in the number of beneficiaries. This begs the question: Is the number of agents increasing at the same rate in those states?

Number of Insurance Agents Across the US

Even with the significant turnover that the industry has in terms of newly licensed agents leaving the ranks, as well as the many agents who decided to retire as a result of the pandemic, there is still a net gain in agents.

That being said, we wanted to shed some light on individual geographical areas.

The Large States

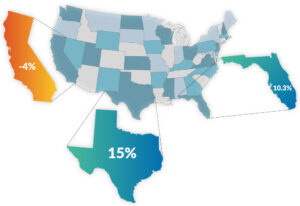

Florida and Texas continue to see explosive growth both in terms of population and number of licensed agents.

For example, Florida had a 10.3% increase in the number of resident agents just in the last year. Texas had an even bigger growth at 15%. In the case of Florida, there was balanced growth in the Life and Health segment compared to the Property and Casualty licensed agents.

Texas, on the other hand, saw faster growth in the number of P&C agents compared to L&H. Still an expansion of 9.7% in total number of resident agents that are life or health licensed is major for a state of that size.

This wasn’t the case with California, however, with a population of agents that dwindled by 4% in the same period.

New York has continued to show growth, although the P&C segment outpaced the L&H segment in the state: 8% compared to only 2%.

Ohio had a double-digit decrease in resident-licensed agents in the last 2 years.

Agent Link offers the most complete agent database platform now available for carriers and IMOs that wish to access this invaluable resource for distribution growth purposes.

Individual Regions of the US

With tremendous growth in states like Florida and Tennessee, the overall outlook in the Southeast region poses a great opportunity for recruiters. The New England area offered a bit of both sides with some growth in New Hampshire but negative numbers in other states.

In the upper Midwest, we saw Illinois stagnate with almost unchanging numbers, while Michigan had explosive double-digit growth in terms of resident-licensed L&H agents.

Other places that saw great increases include the state of Nevada and Utah. While our final numbers in Arizona are still being tabulated, we project great growth there as well.

Capitalizing on the Growth for Agent Recruitment

With new blood constantly being supplied to the industry, an overall growth in sales in the major segments, and population expansion in several states, the question is how do you capitalize and capture a bigger market share?

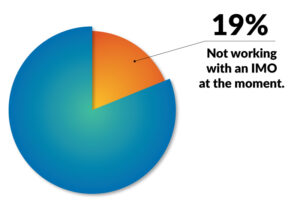

With a whopping 19% of producers not working with an IMO at the moment, and the fact that independents keep their options open, one can see that wholesalers, IMOs, and FMOs growing their independent channel have plenty of game in the near future.

With a whopping 19% of producers not working with an IMO at the moment, and the fact that independents keep their options open, one can see that wholesalers, IMOs, and FMOs growing their independent channel have plenty of game in the near future.

Here’s where strategy really matters, especially depending on the market segment you focus on as not all types of producers have the same need.

What are independent agents looking for?

Agent Link just completed a survey with independent producers of each of the major segments of the industry and captured an up-to-date look at producers’ priorities when it comes to partnering with IMOs and other wholesalers. This provides invaluable information to clients using our help with agent recruitment.

While Quality of Service is of paramount importance to producers, new strategic ideas to grow sales are even more important.

The industry has injected a tremendous amount of technology in recent years, and many producers are receiving the benefit of that.

Groups finding success with recruitment are providing both innovative concepts as well as relief for some of the pain points producers experience in their respective fields.

How to recruit quality producers efficiently?

The game-changer is data. But not the same-ole, same-ole data of years past.

For companies who want to recruit, a quality producer is not merely someone with the right licensing and list of designations. Instead, a quality producer is someone who is active in the right segment of the industry, has relevant experience, and has a mindset that will resonate with your group values.

While some companies offer “agent data,” their focus appears to have gone in the direction of quantity, not quality.

How did we harness the power of better data and more advanced analytics?

Big agent data, when inadequately used or analyzed, can pose more of a barrier than a tool for recruiters.

The first stumbling block is that 30% of licensed agents aren’t even writing any business!

Secondly, a barrier composed of a growing segment of captive agents — captive not just from the point of view of contractual obligations with insurance-based organizations but also restrictions stemming from their financial service affiliations.

Agent lists without the ability to better identify these factors simply wrap the end user in front of a massive list of people, but where are the producers that these end users really want to connect with.

Agent Link has spoken with close to 300,000 active producers and has exclusive access to a massive amount of intelligence on every industry segment. We developed an advanced scoring algorithm that helps our clients have more success.

The future of insurance recruitment lies in data, not expansive, generic databases but precise, tailor-made solutions for each company’s unique needs. As we look ahead, it’s evident that those who embrace this shift will not only secure the best talent but also redefine what effective recruitment looks like in the modern age.

We invite you to reach out to us and ask us for a demonstration of our new and powerful recruitment platform, one that can help you gain a new competitive advantage. We look forward to hearing from you.

Stu Gramajo

CEO and Director of Market Research

Agent Link

Categories

- Martketing (2)

- Recruitment (4)

- Sales Techniques (1)

- Technology (1)

- Uncategorized (1)